Datamaran AI-powered Smart ESG platform

Cut through the complexity and manage ESG in-house with the only smart platform that puts governance first.

Datamaran empowers business leaders with data-driven insights to bring their ESG strategy in-house

Get robust governance oversight

- Understand associated risks and opportunities.

- Make smarter, faster and evidence-based ESG strategy decisions.

- Perform a double materiality assessment to identify key issues.

Stay aware of the evolving landscape

- Track material issues and get a clear line of site of emerging ones.

- Benchmark against peers and monitor ESG regulatory changes.

- Defend and adjust your ESG objectives continuously.

Get disclosure ready

- Understand how to report on key ESG issues.

- Have a clear ESG audit trail.

- Ensuring your ESG strategy is consistent across reporting and communications channels.

.png?width=1000&height=1000&name=website_product_images2%20(1).png)

Align and connect with stakeholders

- Manage cross-functional ESG conversations.

- Get Board and management buy-in to key ESG decision-making.

- Benefit from the replicability of insights to build process and trust.

Organizations adopting the smart way to ESG

Value of the Datamaran platform

Focus on the issues that matter - not having to do it all

Cut through the complexity and manage strategy in-house

Bridge the ESG skills gap by codifying and sharing knowledge

Pre-empt risks and future-proof the organization

Maintain competitive position, reputation and access to capital

Digitize and optimize existing manual ESG processes and controls

Smart ESG testimonials

With Datamaran's data-driven approach to external risk analysis and input from key stakeholders, Hexion is now better positioned with a robust strategy to drive results and systematically monitor our success against ESG risks and opportunities

Datamaran is a critical input to our corporate strategy, risk management, disclosure and engagement… especially when we are reporting the results and sharing this with our executive team and our Board of Directors, this gives them comfort in knowing that we're on it

Datamaran’s unique technology ensures businesses have the actionable and quantifiable data they need to prepare for the rapidly changing expectations of society from corporations. Datamaran brings transformative results to businesses around the world – including Fortive – to accelerate progress for a more sustainable future

Datamaran gave us the worldview we needed to understand emerging issues and trends, including new regulations in the pipeline that could directly or indirectly affect AEP

The knowledge and support your team provides is so helpful, especially in a time with so many projects and questions in a quickly changing environment. I appreciate it a lot

I can happily say this is the easiest relationship I have with a service provider. I never feel any stress or anxiety around double materiality anymore, which is a huge thing because it causes a lot of stress to a lot of companies. It's a pleasure working with Datamaran.

Key platform features

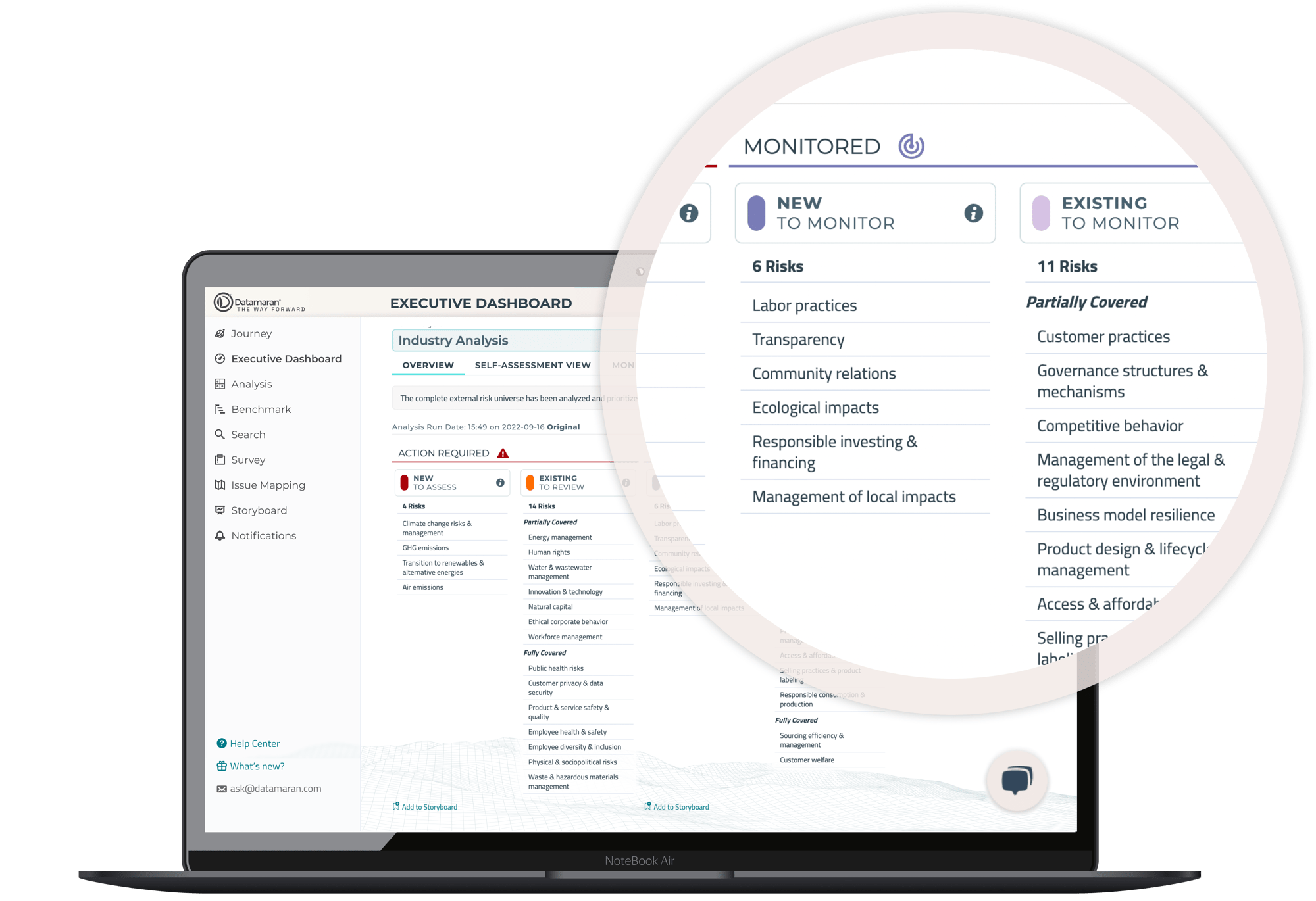

AI-powered insights and summaries

Real-time highly-targeted data access & analysis

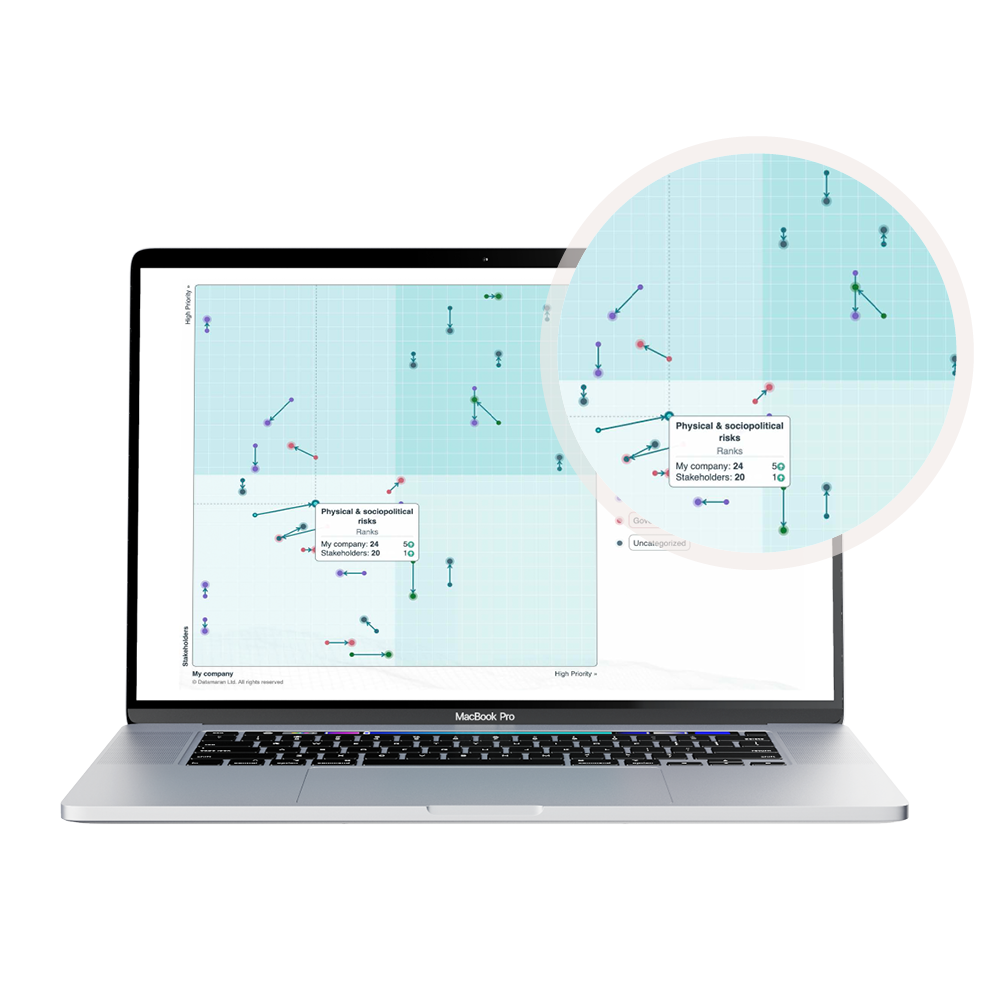

Best in class double materiality assessment

Easy-to-use and quick to set-up platform

Dynamic risk and opportunity monitoring

Peer-to-peer learning via the Datamaran Academy

We’re SOC 2 Type II Compliant and Certified

See how Datamaran can help you

Datamaran is the leader in Smart ESG, enabling companies to identify and prioritize issues material to their operations, deepen their teams’ ESG knowledge, monitor risks and opportunities in real-time and authentically own their ESG strategy in-house. Supported by Datamaran, C-Suite from the world’s most trusted brands are confidently making data-driven decisions and taking their company’s ESG from one-off compliance-focused exercises to governance-centric initiatives that drive business value.

Fill the form on the right to get your complimentary demo of Datamaran.