Welcome to the smart way to

ESG

Datamaran’s AI platform empowers business leaders to confidently navigate the complex ESG landscape by transforming vast amounts of information into actionable insights.

Trusted by Leading Companies Worldwide

Smart ESG

The smart way to ESG empowers business leaders to:

- Start with good governance - focusing on the G in ESG

- Identify and prioritize the issues that are material to your organization

- Elevate your teams with insights to deepen their ESG knowledge and authentically own their strategy

- Monitor your ESG risks and opportunities in real-time

Smart value

Smart ESG unlocks value:

- Use real-time insights for confident decision-making and reporting

- Bring ESG capabilities in-house and save on outsourcing

- Transform ESG from a cost center to a value driver

- Focus only on what matters, mitigating inadvertent greenwashing

What Datamaran use cases do for you

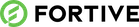

Compare internal priorities with external risks and opportunities

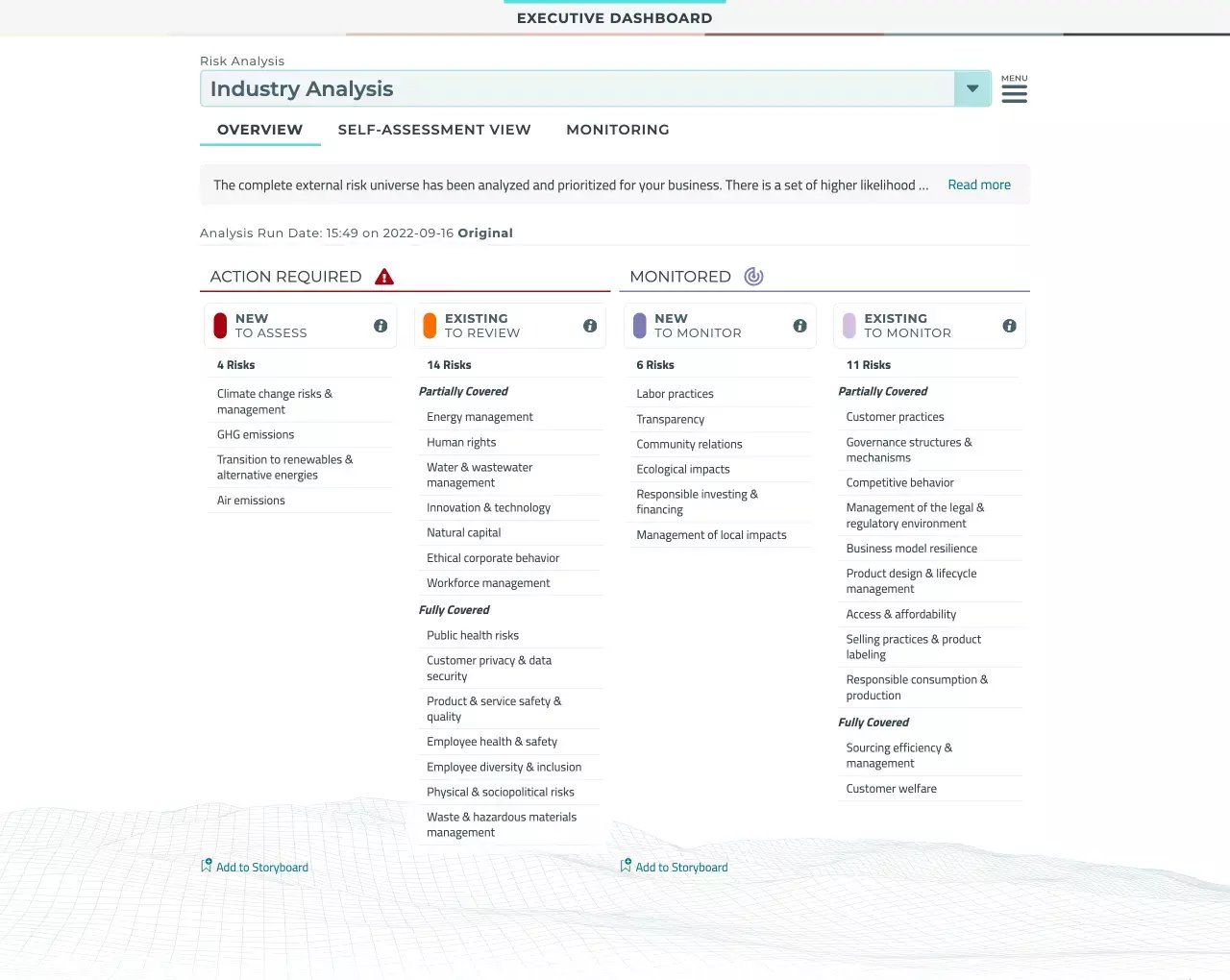

Assess whether your priorities are aligned with the most important issues for your stakeholders

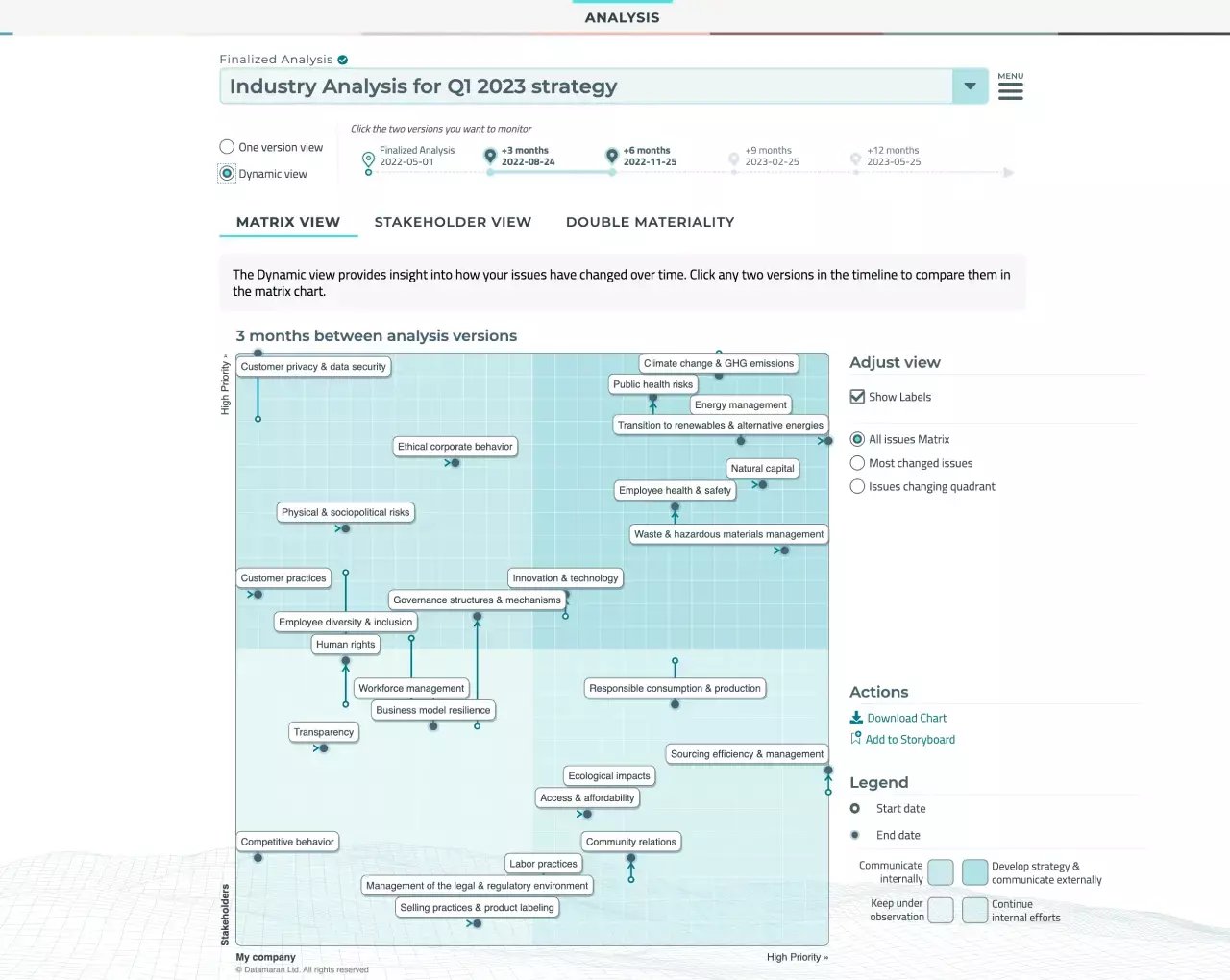

Identify risk drivers, whether, regulatory, reputational or competitive

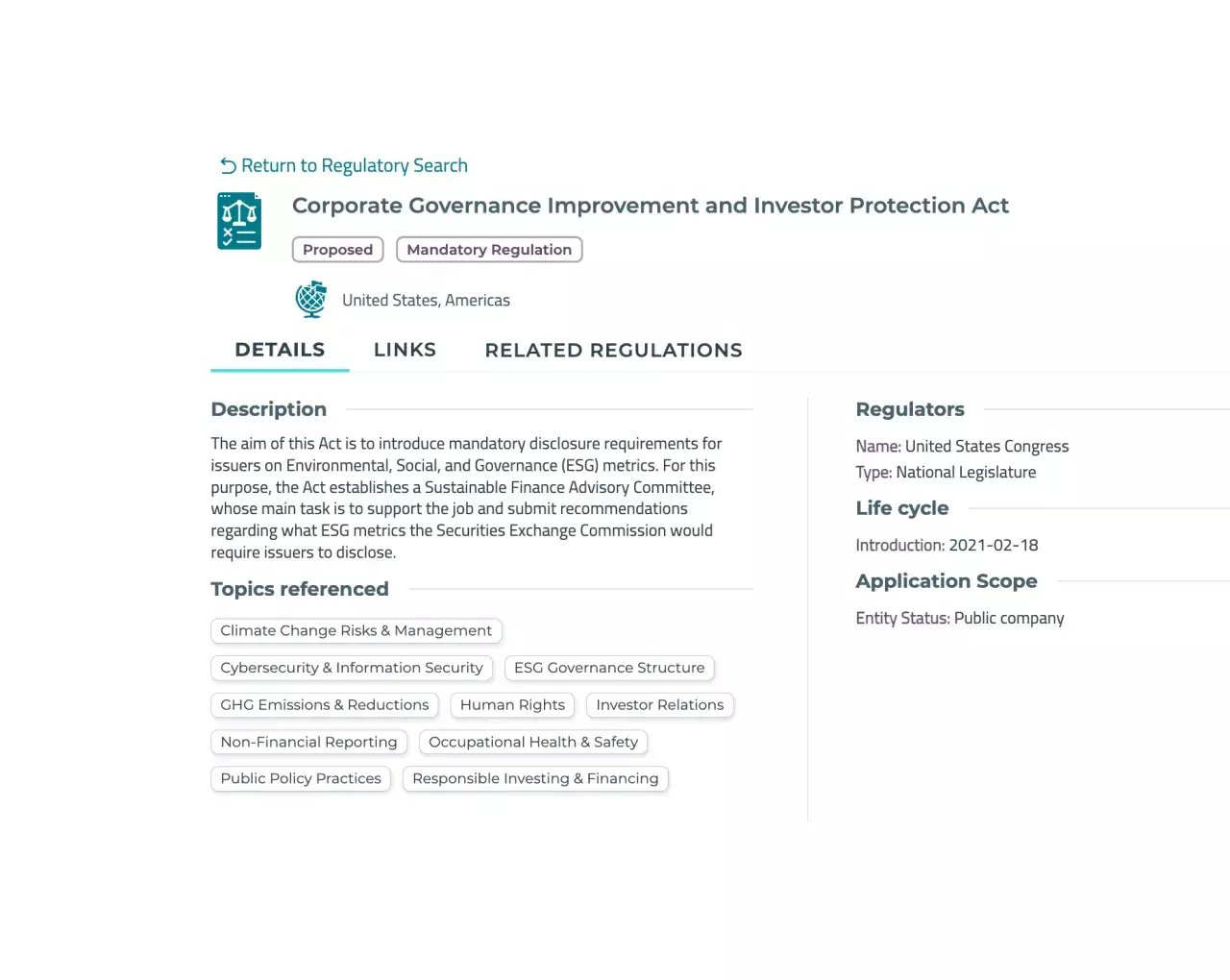

Deep dive into the text of regulations that influence your risk profile

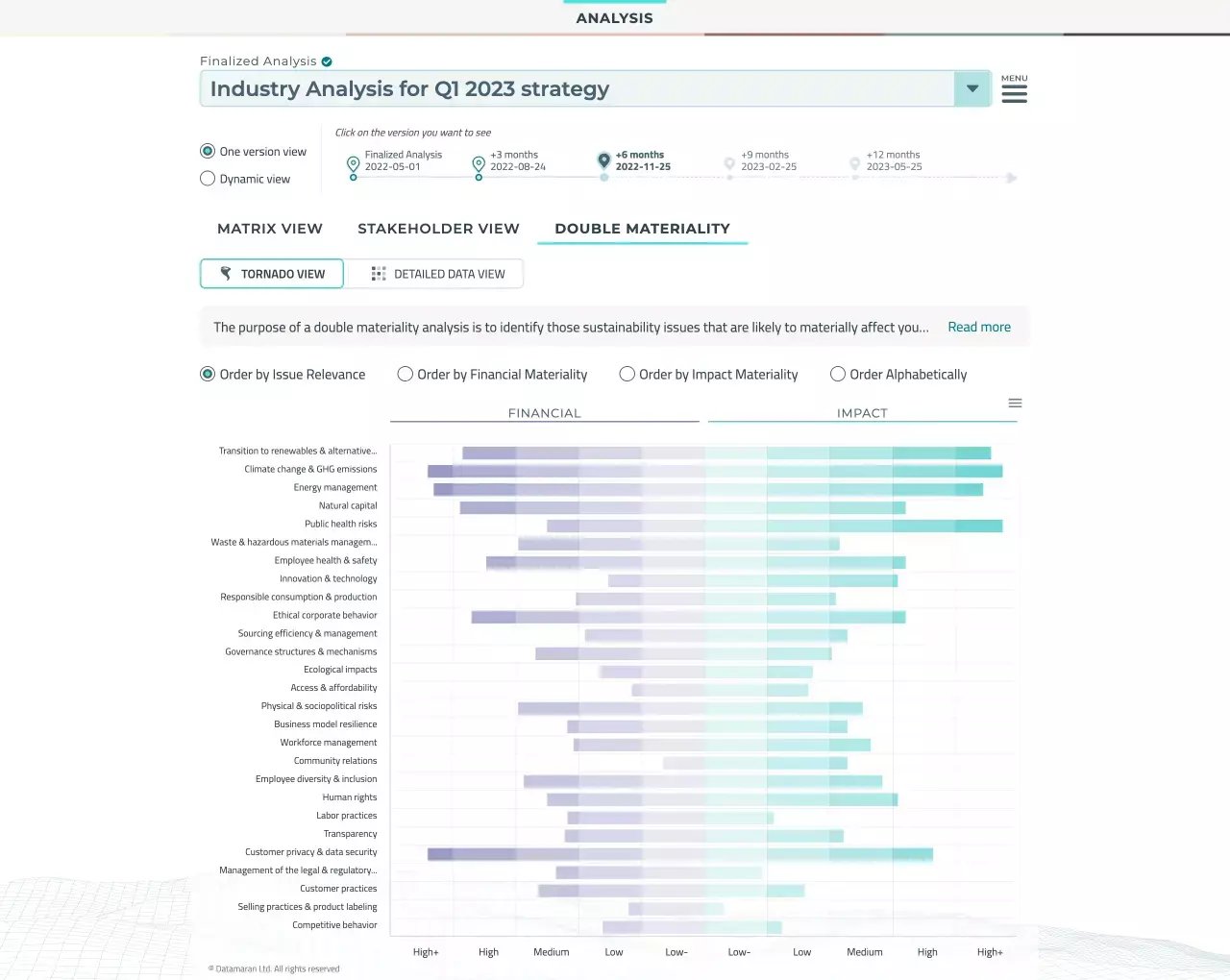

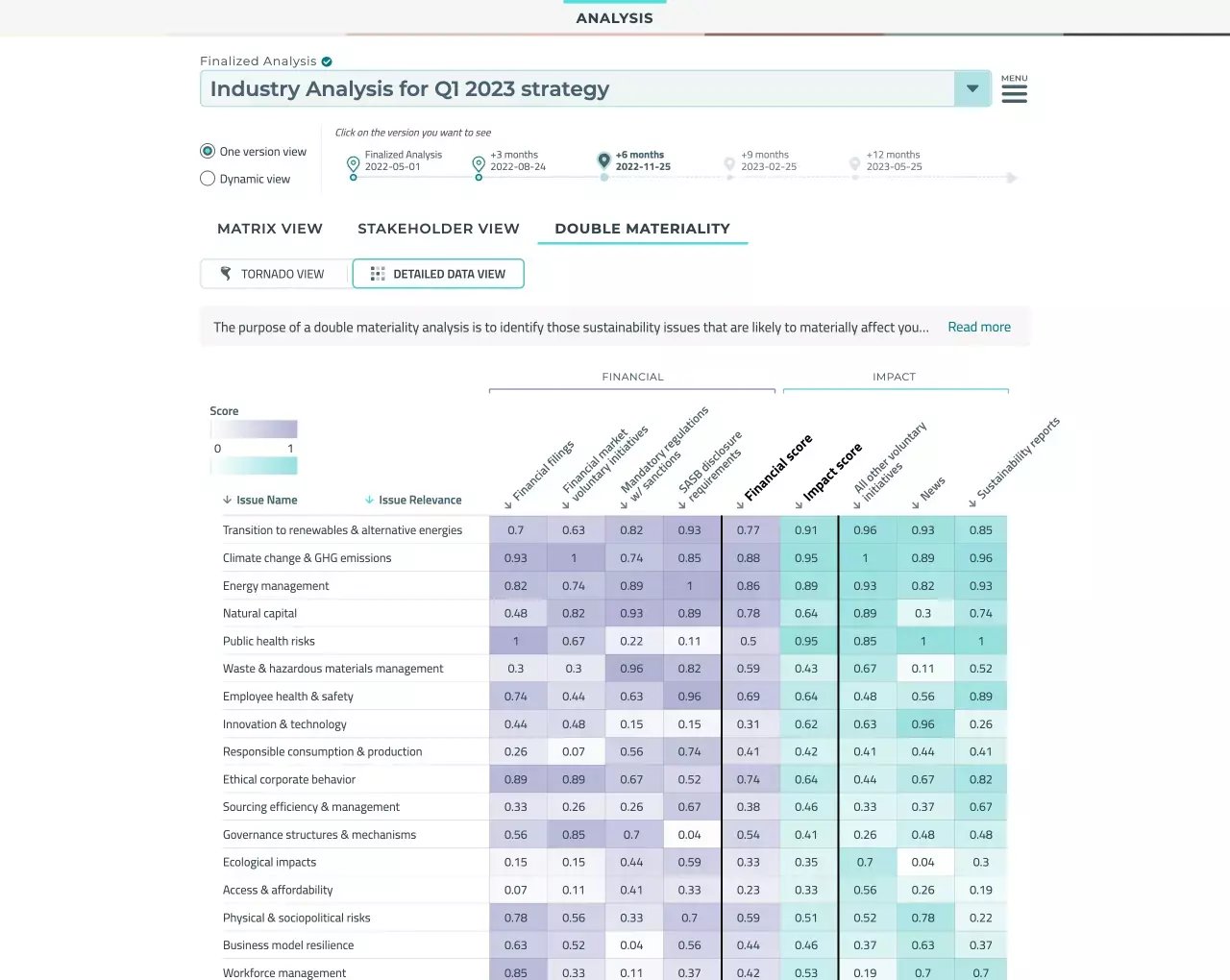

Double materiality analysis to see what materially affects your business and the impact of your business

Get a 30,000 foot view of your own tailored ESG priorities

Detailed breakdown of the different sources used to calculate the double materiality scores

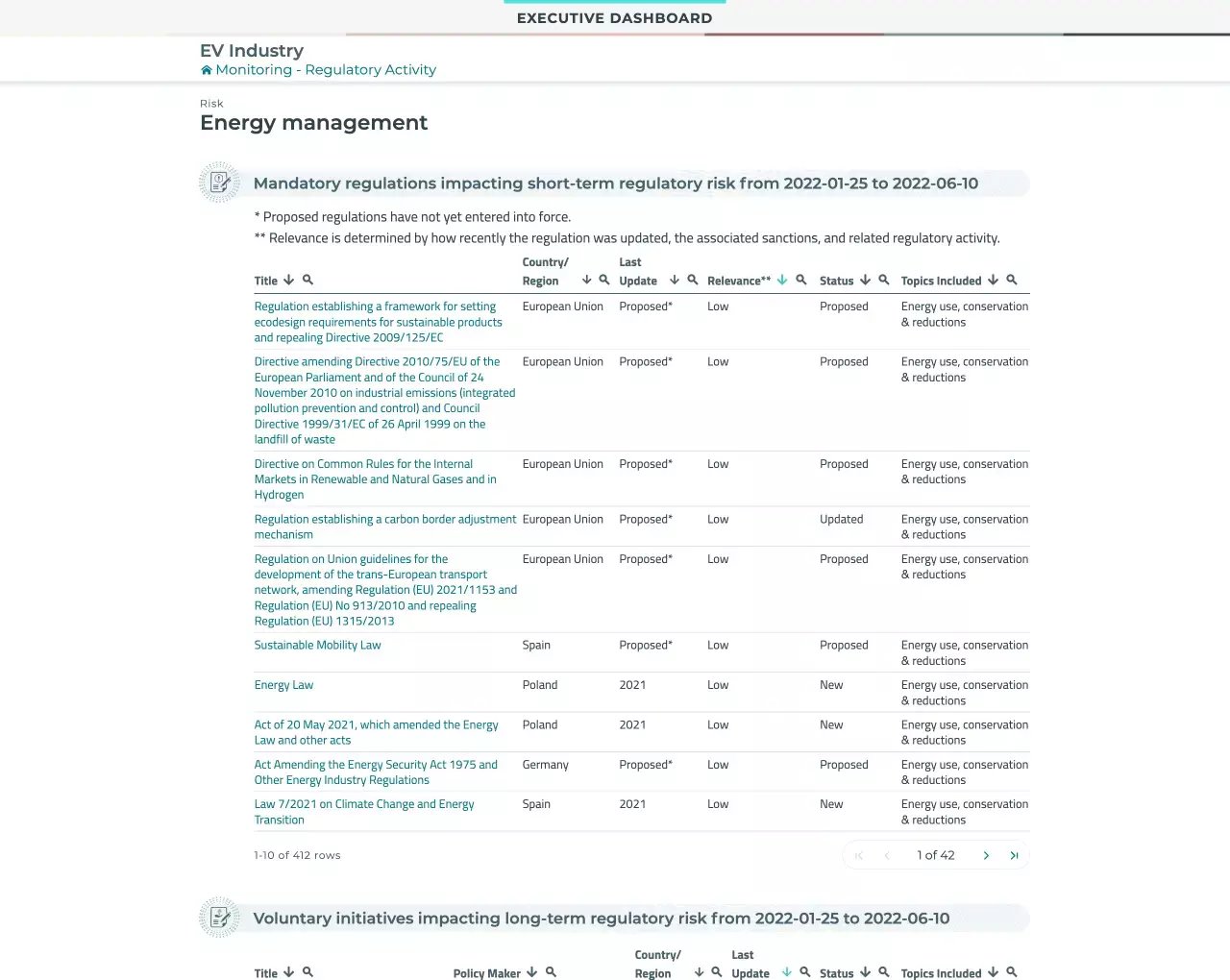

Monitor mandatory and voluntary regulations impacting short/long terms regulatory risk

Smart ESG in action

“Having the Datamaran platform, where all of our topics are housed and displayed, and where we can drill down into what's driving those risks has increased engagement internally and strengthened knowledge of ESG across our executive and our senior management teams.”

Smart ESG testimonials

With Datamaran's data-driven approach to external risk analysis and input from key stakeholders, Hexion is now better positioned with a robust strategy to drive results and systematically monitor our success against ESG risks and opportunities

Datamaran is a critical input to our corporate strategy, risk management, disclosure and engagement… especially when we are reporting the results and sharing this with our executive team and our Board of Directors, this gives them comfort in knowing that we're on it

Datamaran continually anticipates and meets our needs, as our ESG and risk management processes evolve and mature. The platform enables a clear view of business-critical issues across the ever-changing landscape

Datamaran gave us the worldview we needed to understand emerging issues and trends, including new regulations in the pipeline that could directly or indirectly affect AEP

The knowledge and support your team provides is so helpful, especially in a time with so many projects and questions in a quickly changing environment. I appreciate it a lot

I can happily say this is the easiest relationship I have with a service provider. I never feel any stress or anxiety around double materiality anymore, which is a huge thing because it causes a lot of stress to a lot of companies. It's a pleasure working with Datamaran.

Cookie Policy | Privacy Policy | Terms Of Use | Disclaimer | Data Processing Addendum | Voluntary Statements

Copyright 2026 Datamaran, all rights reserved.