The Ultimate Guide to ESG Materiality

Often, materiality is discussed in technical terms with many viewing it as a box-ticking exercise. However, the fundamental aim is simple: align your business strategy with your ESG priorities.

Materiality ensures you focus on what matters, are time efficient and cut costs, all of which are especially vital during challenging economic times. There are hundreds of ESG issues, but materiality helps you define what ESG means for you.

In the absence of a rigorous materiality process, if you outsource your materiality assessment or consider it the sustainability division’s remit (instead of a company remit, or more importantly, the C-suite’s) - you risk exposing your business to inefficiencies, greenwashing accusations and financial penalties.

You’ll find more detail below - essentially, everything you need to know about materiality.

Materiality is the principle corporate leaders apply to understand which Environmental, Social and Governance (ESG) issues to prioritize in their organization’s strategy, budget allocation, risk and opportunity identification.

Understanding which ESG issues to focus on is critical to a company’s longevity; a material issue can have a major impact on a company’s financial performance, value creation, reputation and legal position.

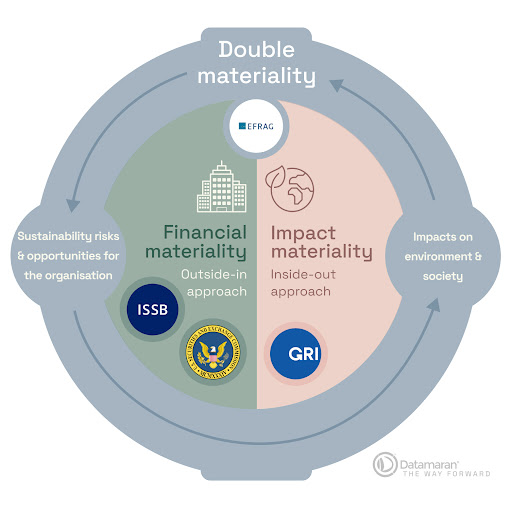

Whilst there are many positions on what constitutes a material issue, the most influential definitions are presented by the:

- U.S. Securities and Exchange Commission (US SEC)

- International Sustainability Standards Board (ISSB)

- Global Reporting Initiative (GRI)

- European Financial Reporting Advisory Group (EFRAG)

US SEC, ISSB | Financial Materiality

According to the US SEC and ISSB, an ESG issue is material if it affects or has the potential to affect the cash flow and financial value creation for a company. This can also be considered an outside-in perspective. Financially material ESG issues are also called dependencies, and they represent sustainability-related risks and opportunities for an organization.

GRI | Impact Materiality

Per GRI, an ESG issue is material based on the impact of an organization and its activities across the value chain on the environment, society and economy. This can also be considered as an inside-out perspective.

EFRAG | Double Materiality

Marrying the definitions above, EFRAG requires the consideration of both the financial and impact materiality of ESG issues. As such, this perspective recognizes that a company can both affect, and be affected by ESG issues.

By capturing both perspectives, the double-materiality approach facilitates a comprehensive understanding of a company’s material sustainability impacts, risks and opportunities. This provides the insights required to inform strategy development, ensure strong governance and enable greater transparency in reporting.

On the topic of double materiality: it’s important to be aware that this is a key requirement faced by many companies. This is a result of the EU Sustainability Reporting Standards (ESRS) recently released by EFRAG.

EFRAG: Mandatory Requirements for Double Materiality

On 25 November 2022, the EFRAG approved the first batch of EU Sustainability Reporting Standards (ESRS). The standards represent a significant milestone in efforts to encourage sustainable business practices through corporate reporting legislation.

Impacting over 50,000 companies, the ESRS will require the disclosure of sustainability risks, impacts and opportunities. To identify these risks, impacts and opportunities, companies are required to adopt a double materiality approach

When these standards must be adopted depends on the profile of your business; for companies headquartered in the EU:

- All large companies already subject to the Non-Financial Reporting Directive (NFRD) will be required to adopt the ESRS from 1 January 2024 (with reports due 2025)

- All other large companies from 1 January 2025 (with reports due in 2026)

- Listed SMEs and other undertakings from 1 January 2026 (with reports due in 2027)

The ESRS is a concern outside of the EU also; non-EU companies with operations in the EU will also be impacted from 1 January 2028 (with reports due in 2029). Specifically, the companies impacted are those with:

- A subsidiary in the EU generating a net turnover exceeding €150m; or,

- A branch in the EU generating more than €40m net turnover.

For more information, here’s a blog outlining six things you should know about EFRAG to get regulatory ready.

Now, before we move on to address how to operationalize materiality through a materiality assessment, it’s important to keep in mind that materiality is not static; it dynamically evolves following changes in the context and stakeholders’ expectations. This concept is defined as:

Dynamic Materiality

What is important to an organization and its key stakeholders is ever-evolving. This has been demonstrated by recent global events such as the pandemic, the Black Lives Matter movement and green energy transition. As such, both needs and expectations of stakeholders can change, meaning what’s immaterial to a business today could be a material issue tomorrow.

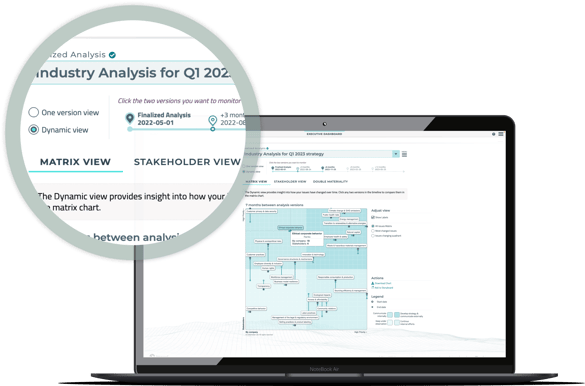

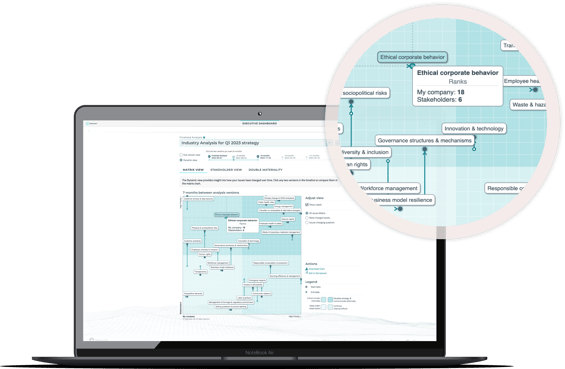

Dynamic materiality analysis insights within Datamaran provide automated, data-driven quarterly updates on how your external stakeholder priorities have evolved.

To keep pace with the ever-evolving ESG landscape, material issues should be considered dynamic, hence the term - dynamic materiality. Through ongoing monitoring of sustainability impacts, risks and opportunities, ESG issues are brought to life. This means companies can ensure their strategy - and resulting efforts - remain relevant to their key external stakeholders.

Deep dive into the underlying data to understand the stakeholder groups driving any changes, informing your decision-making when addressing potential emerging issues.

As set out in EFRAG’s publication on Sustainable Businesses, recommended best practice is to harness technology to manage these issues. To this point, many companies leverage technology to achieve dynamic insights to facilitate robust and ongoing oversight.

What is a Materiality Analysis?

Put simply, it is the process adopted by organizations to identify, prioritize, validate and monitor their specific material issues.

In a world where companies face increasing pressure from both internal and external stakeholders to address numerous different ESG topics, a robust materiality assessment is a critical tool. It enables business leaders to cut through the noise and make informed decisions about where resources need to be allocated and why.

When implemented correctly, this analysis is considered the foundation for the development of one’s ESG strategy, corporate governance and sustainability reporting. To this effect, the evidence provided helps initiate and steer action throughout an organization by validating a company’s approach.

A robust, credible and defensible materiality analysis is:

- Evidence-based and systematic

- Conducted annually in advance of the report preparation

- Involves the highest governance body of the organization in making materiality judgements

How to conduct a robust materiality assessment

Below you will find a simple step-by-step guide to conducting your company’s robust and credible materiality analysis:

.png?width=309&height=309&name=unnamed%20(2).png)

Step 1 | Before you start - establish the appropriate governance structure and process

Engagement

To capture the true strategic priorities of a business, a materiality analysis requires engagement across a company and its stakeholders. Not simply individuals directly involved in the external reporting process. Furthermore, “top-down” engagement is vital for a robust and impactful materiality analysis.

Governance

A governance structure and processes should be established to build, validate and sign off the findings from the materiality assessment. It should then communicate the identified priorities to appropriate functions and teams throughout the business.

Finally, such governance infrastructure will have oversight of action taken on the material issues. It will monitor progress on goals and commitments taken and new emerging issues.

Central to the governance structure should be one or more designated process owners, responsible for project managing the assessment. In addition, for a comprehensive and thorough understanding of the organization’s operations and priorities, a dedicated inter-departmental governance body should be established. They are responsible for coordinating and implementing the materiality assessment process.

Board Oversight

Procedures should also be established to facilitate a flow of information with internal and external stakeholders, in addition to engagement with the Board of Directors. Involvement from the highest level is critical to ensure that the findings of a materiality assessment are effectively integrated into the corporate strategy. It should guide the allocation of appropriate resources (especially funds) for issue-level operational improvements.

.png?width=308&height=308&name=unnamed%20(4).png)

Step 2 | Identify the universe of issues to assess

Issue Identification

A multi-source approach should be adopted to take into account different stakeholder perspectives and identify the broadest universe of issues that can apply to your business. Examples of sources to consider include Legislation (e.g. CSRD), Frameworks and Standards (e.g. GRI, SASB, IFRS), peer corporate reports and annual filings as well as online news.

Review and Refine

This universe should contain issues that are complete and unique, avoiding any overlap and redundancy, to facilitate a clear representation of the material analysis results. It should also be dynamic, taking into account new issues as they emerge. Potentially material entity-specific issues that are not covered in standards should be included too.

.png?width=307&height=307&name=unnamed%20(5).png)

Step 3 | Gather evidence to reveal the materiality of the issues in your universe

Multi-source Approach

To achieve a robust and objective approach, multiple sources should also be leveraged to gather evidence and triangulate the insights. During this exercise, the viewpoints of the organization and its internal stakeholders should be considered - specifically, the company’s strategic stance, outlook and vision.

Furthermore, the viewpoints of key external stakeholders should also be considered. Such evidence can be gathered through stakeholder engagement such as surveys, workshops or interviews, as well as reviews of sources such as annual disclosures, mandatory regulations, voluntary initiatives and online news.

- Best Practice: A common theme presented by standards on materiality is the importance of internal and external stakeholder engagement in the identification of material topics.

- Best Practice: Document and build an audit trail of your evidence-gathering and analysis process to be ready for internal audit and third-party assurance.

Conducting the Assessment

When conducting a materiality assessment, gather evidence demonstrating the likelihood, scale and scope of both directions of impacts: outside-in for financial materiality and inside-out for impact materiality.

In particular, from a financial materiality perspective, the materiality of an issue can be measured by considering the probability of occurrence and the magnitude of the financial effects. Conversely, according to an impact materiality perspective, the materiality of an issue can be measured by the severity and likelihood of the impact on the environment and/or people.

Disclosing the Assessment

Standards prescribe different ways to disclose information on the company’s materiality assessment. Generally speaking, disclosures should cover:

- The process followed to identify material issues

- The outcome of the materiality assessment, i.e. the list of material topics

- How material topics are managed and monitored

While in the past a materiality matrix has been the recommended visualization to represent the outcome of a materiality assessment, this is no longer the case. Currently, no standard requires or makes reference to a materiality matrix.

Materiality Threshold

Furthermore, to identify the most material issues, a threshold that distinguishes material from non-material issues is determined. This threshold is a fundamental source of accountability. As such it should be reviewed and validated with the company’s highest governance body.

.png?width=309&height=309&name=unnamed%20(8).png)

Step 4 | Validation of your material issues

Stakeholder Validation

To validate the material issues identified, stakeholder interests and expectations should be taken into account. The approach for validation is not standardized and can be adapted for the different stakeholder groups. The main examples of engagement channels include surveys, interviews, meetings and workshops.

The evidence gathered during Step 3 is essential to ensure an unbiased and effective engagement with the different stakeholder groups. Stakeholders should be presented with the information collected in Step 3 to enable an informed and productive dialogue.

Board Review

The Board, with the support of top management and the interdepartmental body, determines the materiality thresholds and, consequently, which issues are material. It is essential that the Board has a full overview of the materiality assessment process and is presented the collected and analyzed evidence - both via stakeholder engagement and data analysis.

.png?width=309&height=309&name=unnamed%20(6).png)

Step 5 | Act on your materiality results

Next Steps Beyond Materiality

Once a company’s material ESG issues have been finalized, the next step is to integrate these findings within the business. To extract the full value from the materiality assessment, the focus here should be two-fold: internal action and external reporting.

Internal Action

Firstly, there are internal implications. The ESG priorities revealed through the assessment should be reflected in the company’s corporate strategy to ensure it’s aligned with internal and external stakeholder expectations. Furthermore, the results should be taken into account when:

- Forecasting and planning

- Determining the remuneration policy

- Allocating budgets and setting goals

- Publishing commitments and policies

- Best practice: Standards require the reporting of a company’s management of material topics once a materiality assessment has been completed, including the use of targets and monitoring, policies and procedures, management and initiatives.

Material issues are also closely linked to business risks, meaning that the analysis could lead to the identification of new risks to be included in the risk inventory.

External Reporting

There are also external implications for your materiality analysis, with the results informing the preparation of annual corporate reporting, ensuring the internal and external needs are met.

Disclosure of Findings & Responses

To effectively communicate how stakeholder expectations are being addressed, the following points should be documented in your disclosures:

- Why an issue is material

- How the issue affects the organization, the environment or the people, also through quantitative or qualitative indicators or descriptions

- How the business is addressing or will address the issue, illustrating goals, actions, policies, and plans

- How the company is directly or indirectly involved in the issue

Methodology Disclosure

Beyond the in-depth analysis of the material issues, the report should also detail the process through which the ESG priorities were identified. Such disclosure is key to ensuring transparency and effectiveness of the report, as well as demonstrating the soundness and credibility of the broader strategy, risk management and planning of the organization.

- Best practices: Annual disclosures are a common requirement or recommendation, including an assessment of material impacts.

.png?width=309&height=309&name=unnamed%20(7).png)

Step 6 | Monitor the dynamic evolution of materiality

Assess the Evolution of Stakeholder Priorities

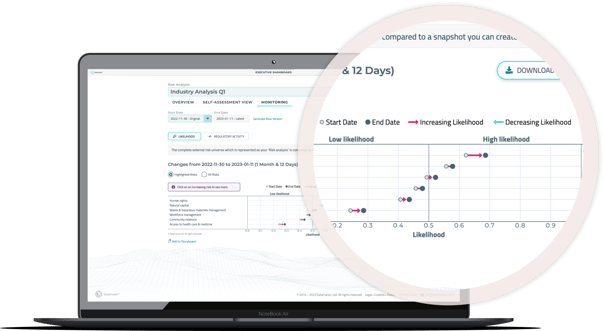

In the same way internal and external needs and expectations evolve over time, so do a company’s material issues. As such, the impact an issue has on the organization, the environment, or people may change (both positively and negatively). This includes how the business is addressing or will address the issue.

The Datamaran Monitoring capabilities enable you to monitor the evolution of your strategic priorities at any time.

Materiality Analysis Frequency

Given how stakeholder priorities evolve over time, the materiality assessment process should be updated regularly, at least before each reporting period. It should not be considered a one-off, box-ticking exercise. Materiality assessments every two or three years are not aligned with the requirements of any standard.

- Best practice: Material issues and impact should be monitored throughout the year and the materiality assessment results updated before each reporting cycle.

- Best practice: Given the scope, dynamic nature and breadth of data needed for a materiality assessment, leveraging technology is the only way to achieve a scalable, accurate and reliable process.

Dynamic Analysis & Strategy

To ensure corporate strategy and resulting workflows remain relevant and aligned with the ESG priorities, the evolution of materiality insights should be presented to Risk, ESG committees and the Board. This will enable more effective decision-making from the top down and ensure transparent corporate reporting that’s truly reflective of a company's activities.

A Brief History of Materiality

The concept of materiality has been present since the first draft of the GRI guidelines published in 1999. However, it has been brought into the public spotlight in the sustainability context by GRI in their G3 Guidelines in 2006 – the cornerstone of the GRI Sustainability Reporting Framework.

It has quickly become essential for stakeholder engagement exercises and topic mapping while appearing as a keyword in consultant pitches. Sustainability professionals around the world clambered to understand the term and the process, outlined by standard setters like the GRI and the International Integrated Reporting Council (IIRC).

Materiality was a concept borrowed from the accounting and auditing domain. It represented the perfect idea to foster the integration of non-financial issues in mainstream business thinking and decision-making. It sounds professional, financially relevant, and familiar to investors and auditors.

The Ultimate Guide to Double Materiality - How to get started in 6 simple steps

Consequently, business leaders need to have a clear and defensible position on their material ESG issues, underpinned by a credible process for identifying and managing these issues.

Download this free ebook to explore regulatory requirements and best practices for conducting a double materiality assessment in 6 simple steps.

By submitting this form you agree to receive the latest news and updates from Datamaran. We will only send you relevant information.

You can revoke your consent at any time by using the Unsubscribe link, found at the bottom of every email. Check our privacy policy here and our terms of use here.

Datamaran Ltd. is the Data Controller. Privacy-related questions can be directed to our DPO at legal@datamaran.com.